The Edmonton Oilers fell to the Colorado Avalanche on Monday night, putting all eight Pacific Division teams into offseason mode. The 21/22 season was an eventful one in the Pacific. The incumbent favorite Vegas Golden Knights missed the playoffs for the first time in their history. The Calgary Flames and Edmonton Oilers both staked claims for division supremacy as the Battle of Alberta returned to the playoffs after a 31 year hiatus. The Los Angeles Kings led a surge from the rebuilding California teams and surprised many with a playoff appearance.

What’s in store for the Pacific Division in 22/23? Which teams are the early favorites? Which teams have cap flexibility to improve this offseason? Which teams are in cap purgatory and have some difficult decisions ahead?

For the analysis below, we’ll make a few key assumptions. First, we’ll assume that all RFAs will return to their current clubs. Their impact is included in the team projections, however no cap hit is included in the team totals. Obviously, some of their team’s cap space will be required to resign these players so we’ll make note of potential cap headaches where applicable. Second, all UFAs are removed from the rosters. Any resulting holes in the roster have been filled with replacement level players.

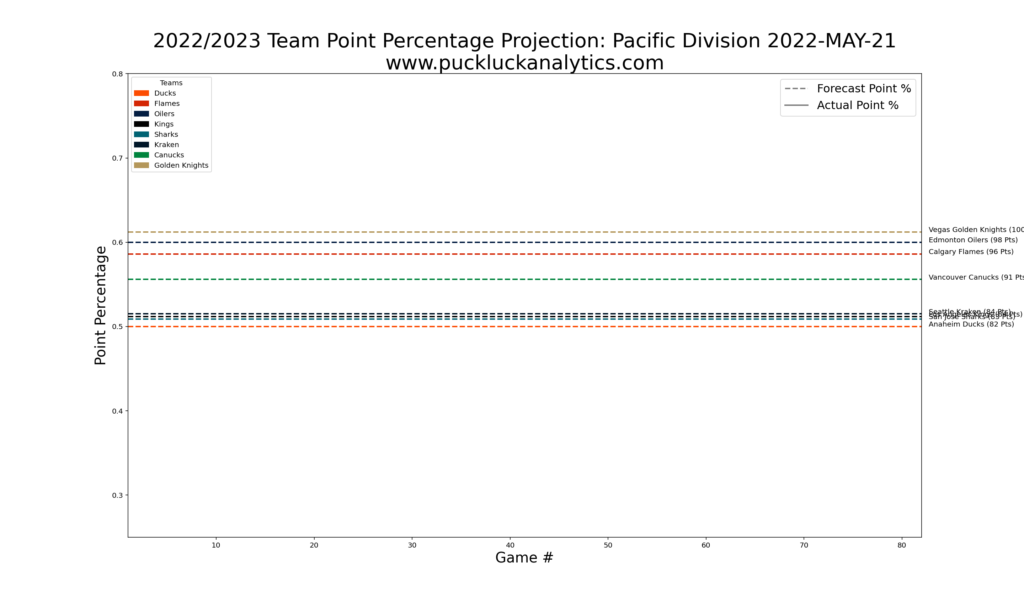

Pacific Division Projected Standings

With rosters adjusted as described above, the Golden Knights remain the team to beat in the Pacific Division. The Oilers and Flames are close behind, followed by the Vancouver Canucks. The three California based teams and Seattle Kraken sit in a tight group well back of the leaders.

Obviously, there is an entire offseason ahead that could change this outlook. Each team has a unique set of roster construction and cap space considerations as the offseason gets underway. How might the landscape change over the offseason? Let’s take a look at each team’s situation, in order of the current projected standings, to see which teams have the most potential to improve over the offseason.

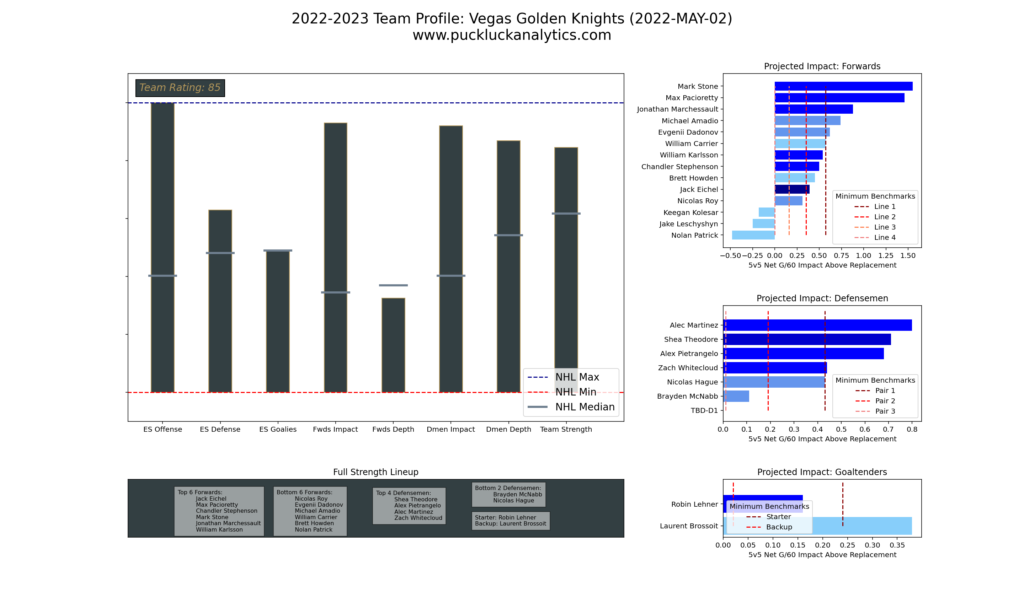

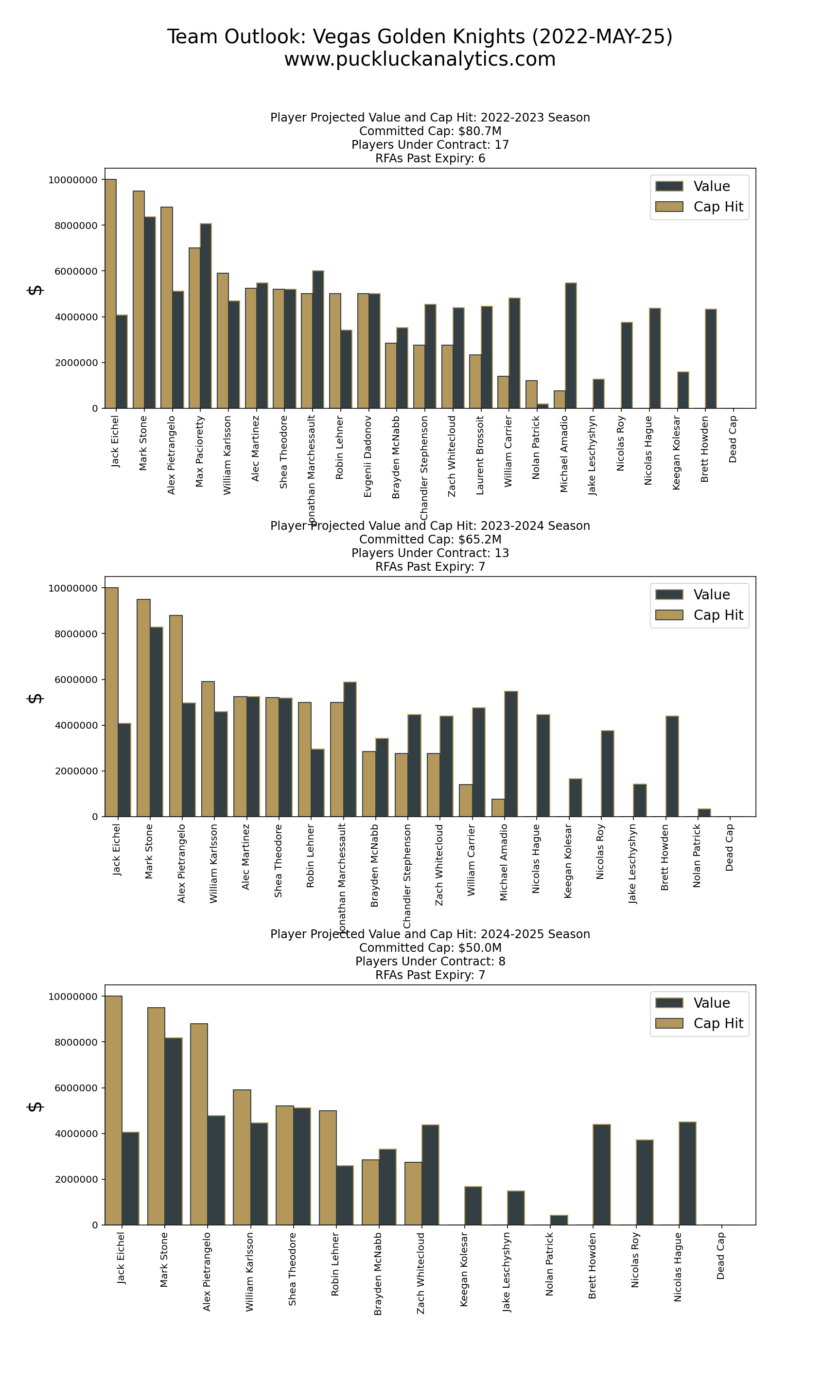

Vegas Golden Knights

The Vegas Golden Knights remain the team to beat in the Pacific despite missing the playoffs in 21/22. Injuries to their star players piled up last season and a healthy Vegas team still looks quite formidable on paper. They have the highest ranked 5v5 offense in the league, led by veterans Mark Stone and Max Pacioretty, and they have one of the strongest and deepest blue lines in the NHL.

Where things get interesting for the Golden Knights is the salary cap. When they acquired Jack Eichel last season, they created a cap crunch for themselves that will play out this offseason. With over $80M committed to just 17 players, there simply isn’t enough cap space available to fill out the rest of their roster.

Vegas needs to add 6 players to get to a full 23 player roster and they have less than $2.5M in available cap space. Even if they only add players at league minimum salary, they need $4.5M to fill out their roster. While we’ve included their RFAs in the roster profile above, they don’t currently have the cap space to ink them to new deals. Something has to give. The Golden Knights have put themselves into cap purgatory and look almost certain to see their roster strength decline this offseason as they work their way into salary cap compliance. The door is open for other Pacific Division teams to make a move.

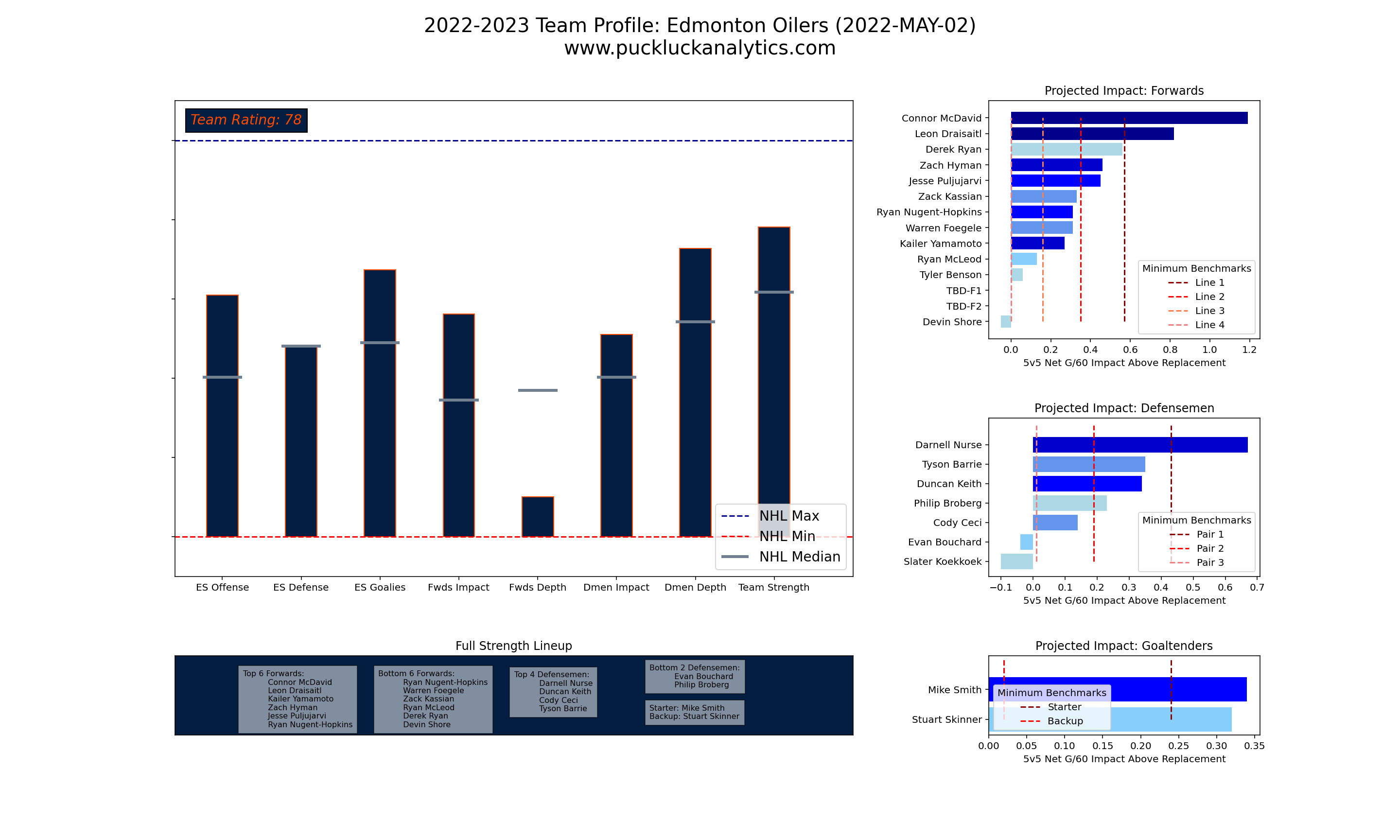

Edmonton Oilers

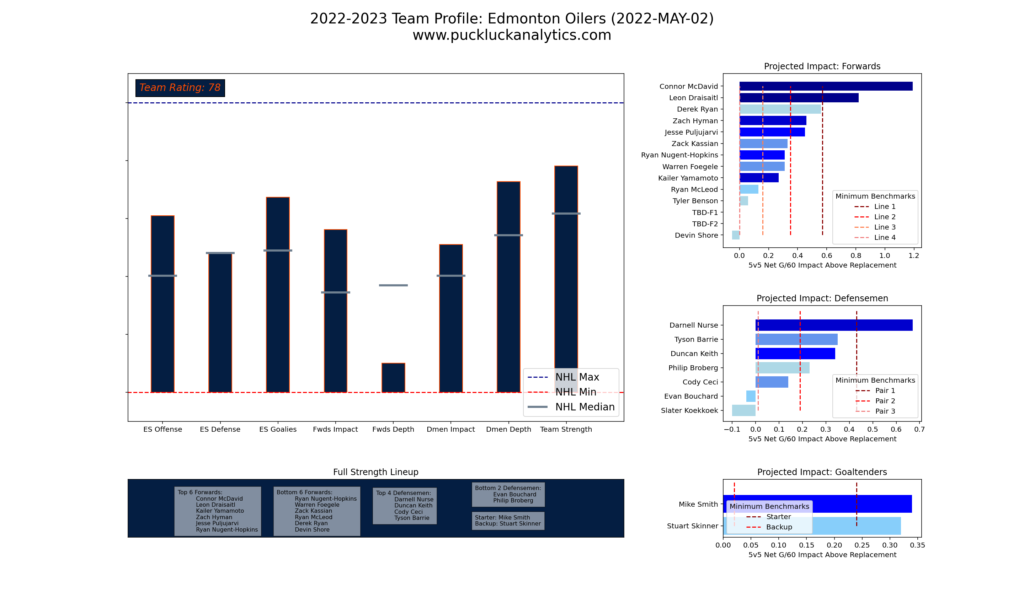

Coming off their run to the Western Conference Final, the Edmonton Oilers are the top challenger in the Pacific going into the offseason. Their forward depth stands out as a glaring weakness on an otherwise above average roster. Connor McDavid and Leon Draisaitl put the league on notice this spring that they can drag this team to victory when they are at the top of their game. If the Oilers can lessen the skill gap between their two superstars and the rest of their forwards, they could be a force next season.

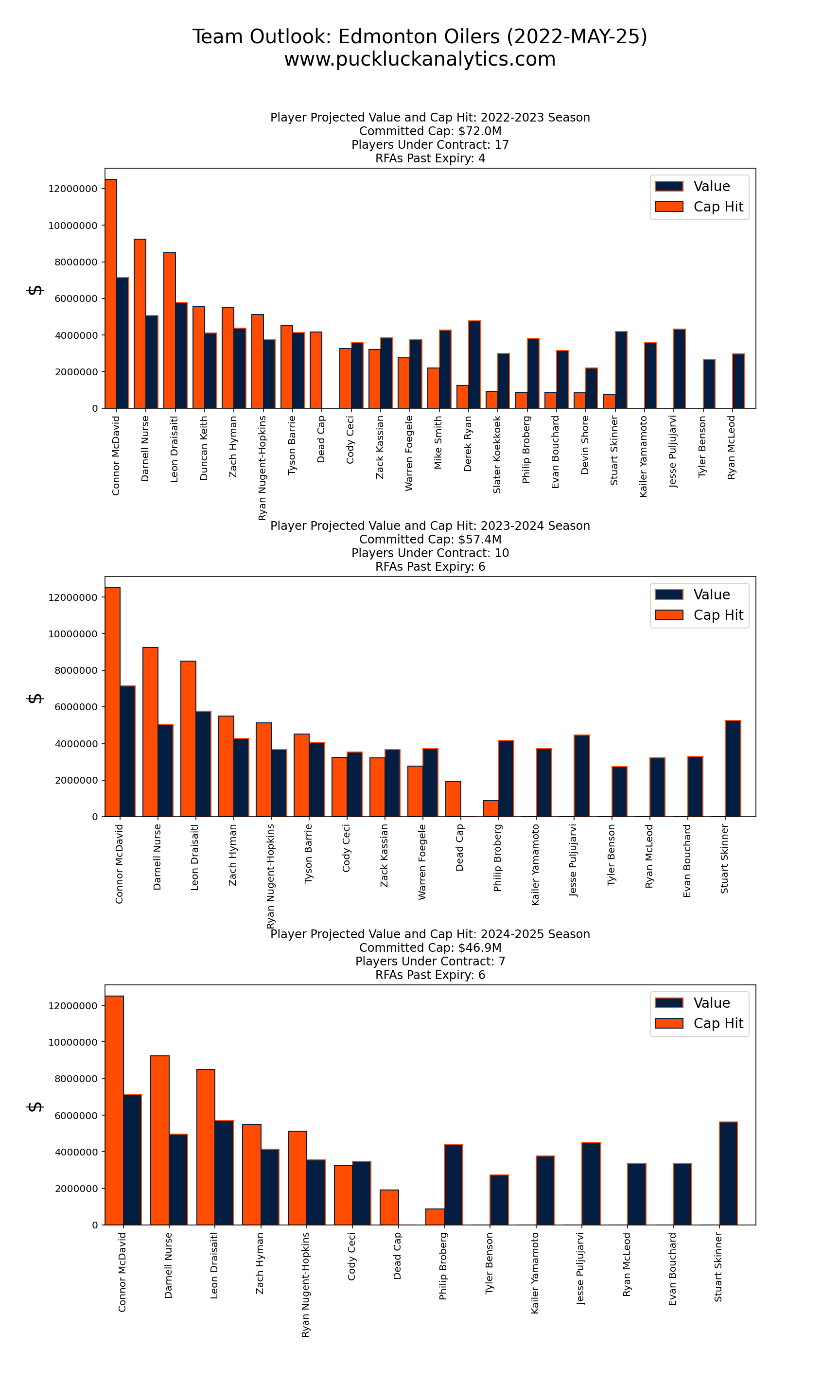

The challenge for the Oilers finding a way to upgrade their roster will be the limited cap space they enter the offseason with. With $10.5M available to sign 6 players, that’s an average of $1.75M they can allocate to each player.

Jesse Puljujarvi, Kailer Yamamoto and Ryan McLeod are all RFAs this summer and it’s hard to imagine that extending that trio won’t eat up a large chunk of the Oilers’ available cap space. That would leave the Oilers adding a trio of near league minimum contracts to fill out the roster, which isn’t a recipe to upgrade the roster. Edmonton will have to get creative with their offseason moves to achieve any significant improvements to their roster before opening night. It seems more likely that their roster strength will look similar to what it does now.

Calgary Flames

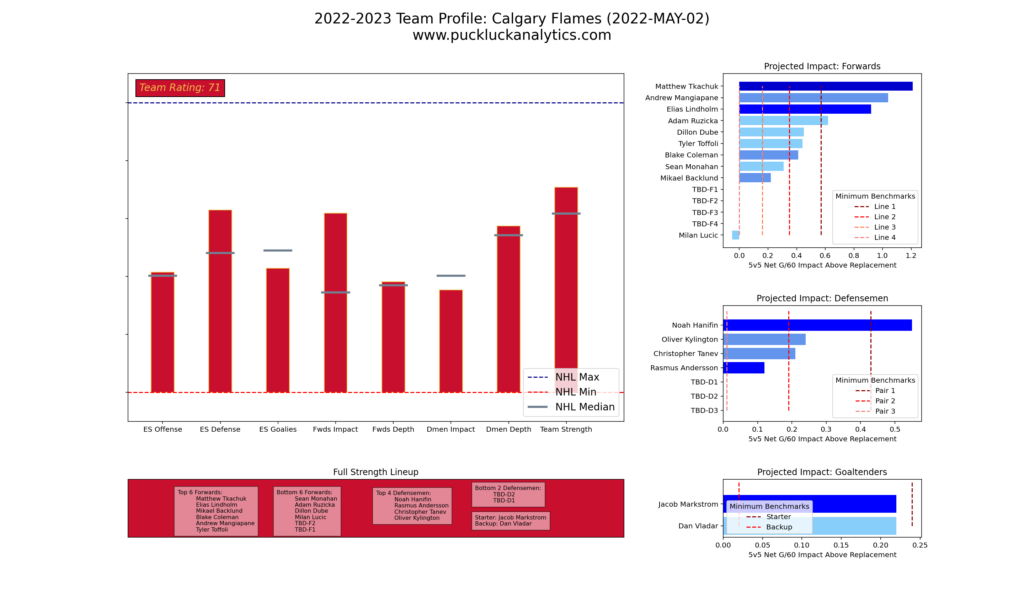

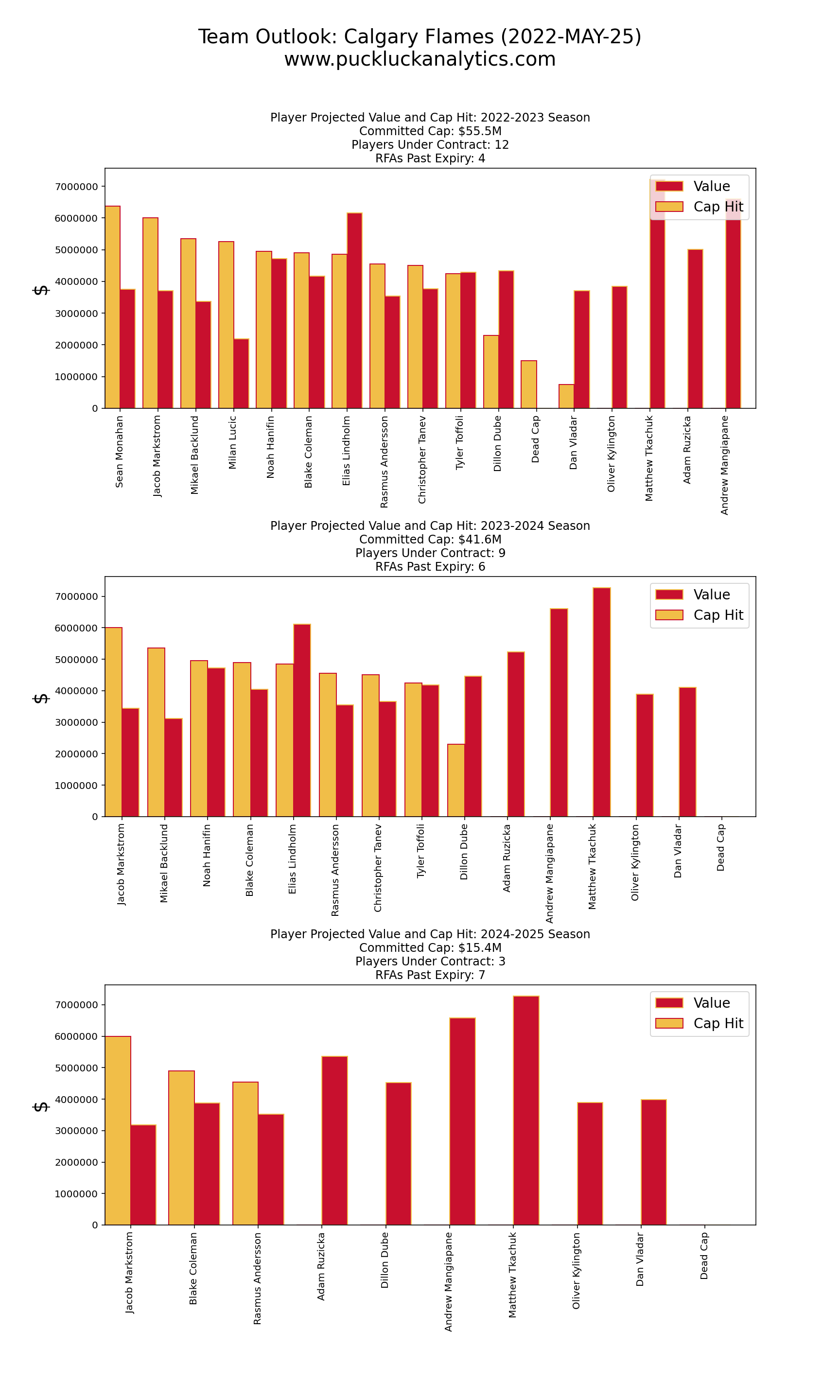

After earning the top seed in the Pacific last season, the Calgary Flames drop to third spot in the 22/23 projections entering the offseason. Team defense and the strength of their forward group are their biggest strengths. The potential loss of Johnny Gaudreau to free agency plays a large role in their positioning at this stage, but resulting cap space leaves them with potential for improvement in the offseason.

The Flames have some heavy lifting to do this offseason. Re-signing the aforementioned Gaudreau might be priority #1, but the team has other business to look after as well. Matthew Tkachuk, Andrew Mangiapane and Oliver Kylington were all key cogs for the Flames last season and are all pending RFAs. They also have just 12 players under contract for next season, so there are plenty of holes to fill before opening night.

With $27M in available cap space, Calgary has some flexibility this offseason. The difficultly is that it will likely take most of that cap space to extend their key RFAs and re-sign Gaudreau. If that’s the plan, they likely have to move some salary out in order to fill out the rest of the roster. There are a few options, such as Sean Monahan and Milan Lucic, where the Flames could gain a sizable amount of cap space by moving a player out. It’s hard to see them making large improvements this summer, although they have more potential than the two teams they are chasing simply because they have more cap and roster flexibility.

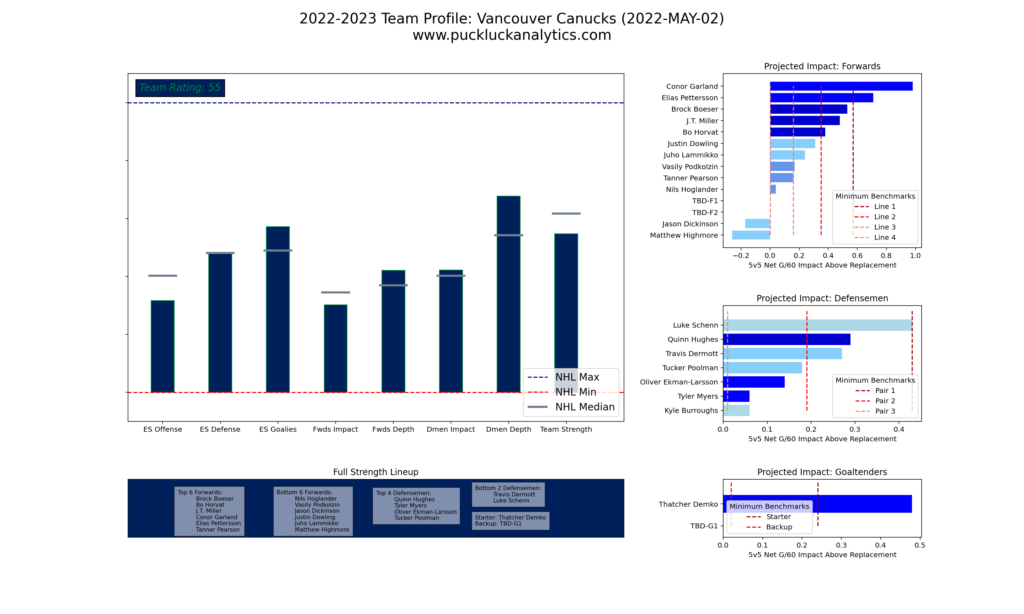

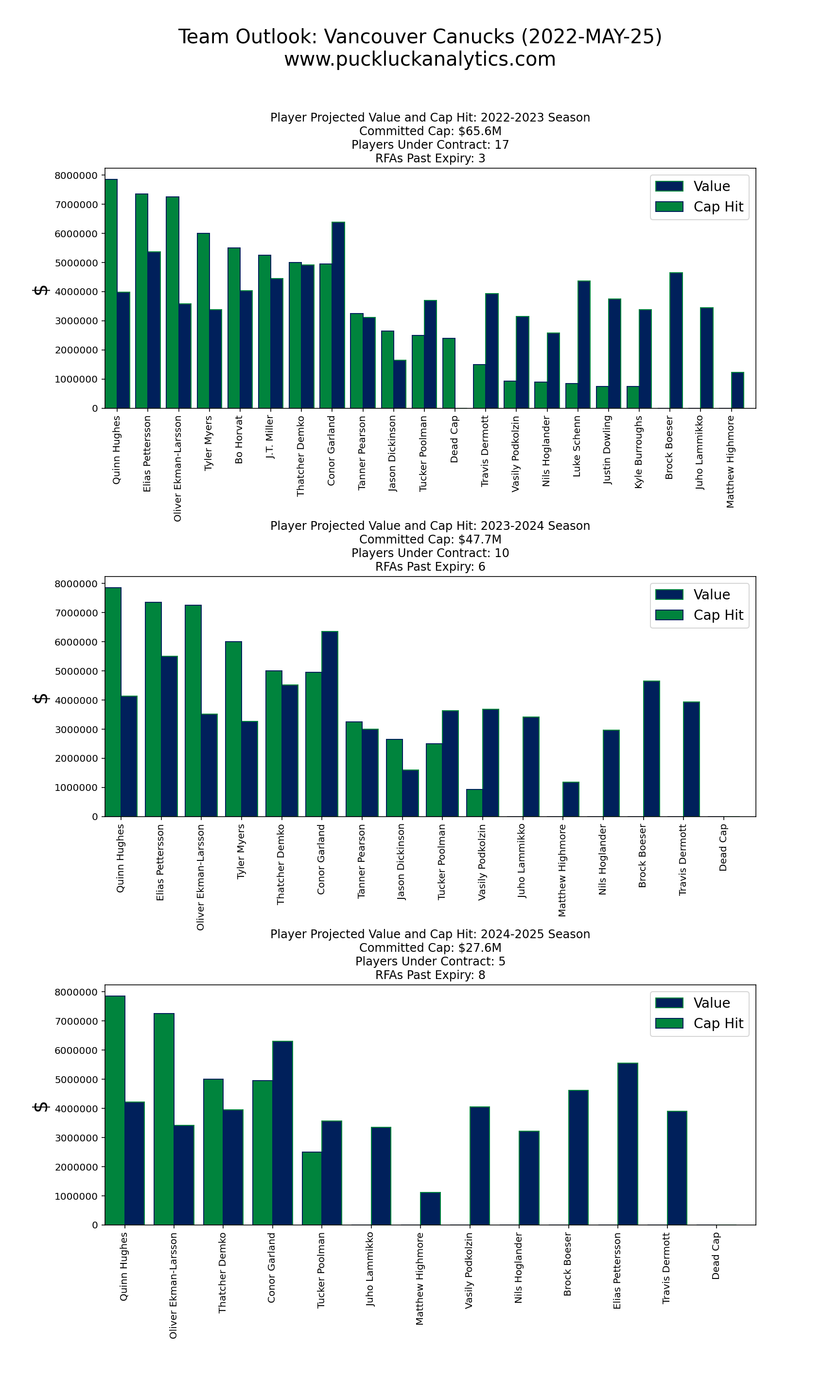

Vancouver Canucks

The Vancouver Canucks looked much better after their coaching change last season but it wasn’t enough to get them into the postseason. With a roster that looks rather average all-around heading into the offseason, they’ll need to make some improvements over the offseason if they hope to be in playoff contention next season.

The Canucks have 17 players under contract for next season, with about $17M in cap space available to fill out the roster. Re-signing RFA Brock Boeser will eat into that, but there should be enough cap space to add an impact player or two.

The Canucks lack of high impact defensemen is one of the areas where they could make improvements this summer. The loss of Chris Tanev to two seasons ago seemed to affect Quinn Hughes overall impact and adding a top pair defense-first defenseman could be a large boon for the Canucks. Their top six forwards could also use an upgrade so using some of their cap space to target an top six forward could pay dividends. The Canucks have more potential to improve this offseason than the teams ahead of them and could be in a position to challenge the top three by opening night. Vancouver also has a few highly inefficient contracts in Oliver Ekman Larsson and Tyler Myers. If they can find a way to move one or both of those, the potential is even greater.

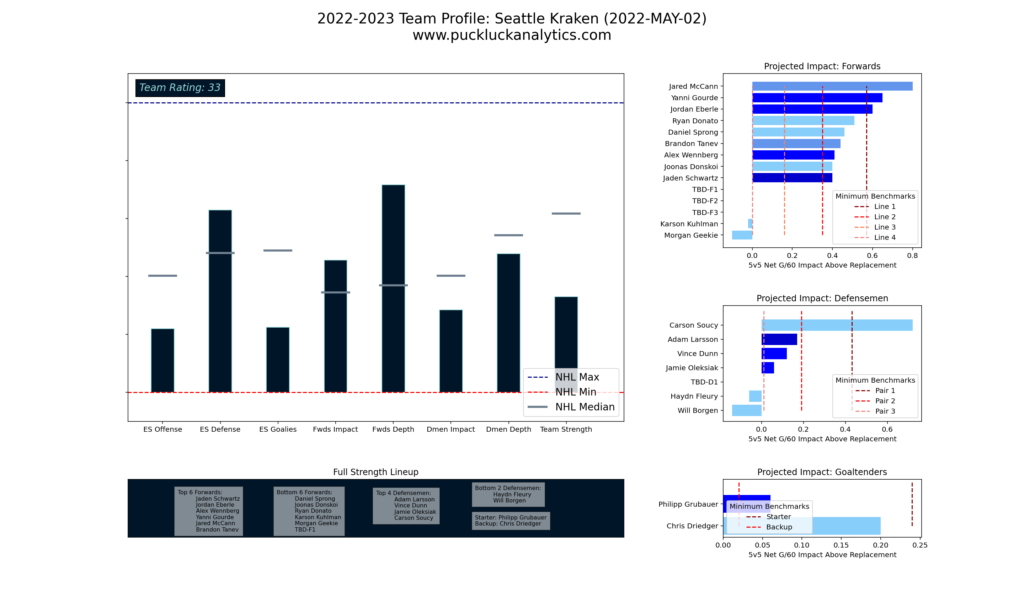

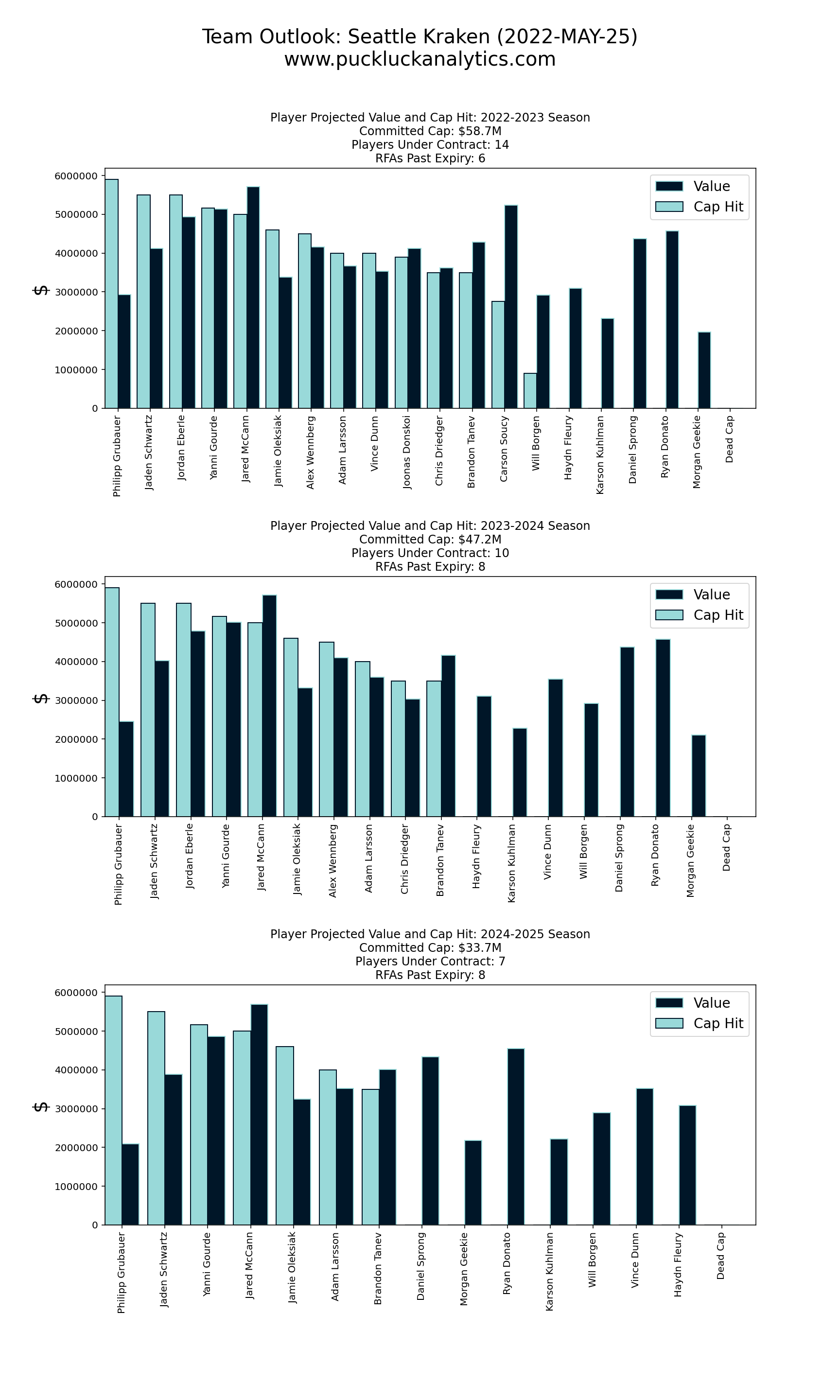

Seattle Kraken

The Seattle Kraken were beloved by most analytical models going into their inaugural season. The season didn’t turn so well, though, as their goaltending struggled mightily. They look like a much weaker team heading into the 2022 offseason, but their general profile remains similar. Team defense and overall depth are their strengths, while they are projected to be offensively challenged. With last season’s goaltending results factoring into the player projections, goaltending now also appears to be a weakness.

The good news for the Kraken is that they have plenty of cap space to work with this summer. They only have 14 returning players under contract for next season, so they have flexibility to add even if they bring back all of their RFAs. The UFA class this year has lots of forward options and they may be able to add a high impact forward or two via free agency with their nearly $25M in available cap space. The Kraken need more help on the blue line though, where the UFA options aren’t as plentiful, so they may be forced to the trade market to shore up the back end. With the right moves, the Kraken could be a team in a position to try to push their way into playoff contention next season.

Los Angeles Kings

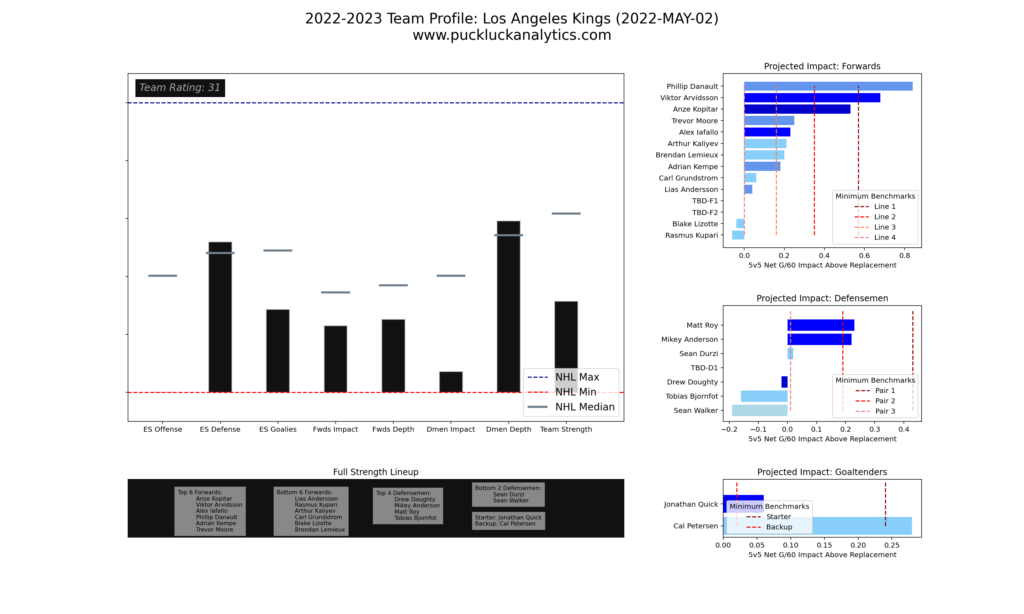

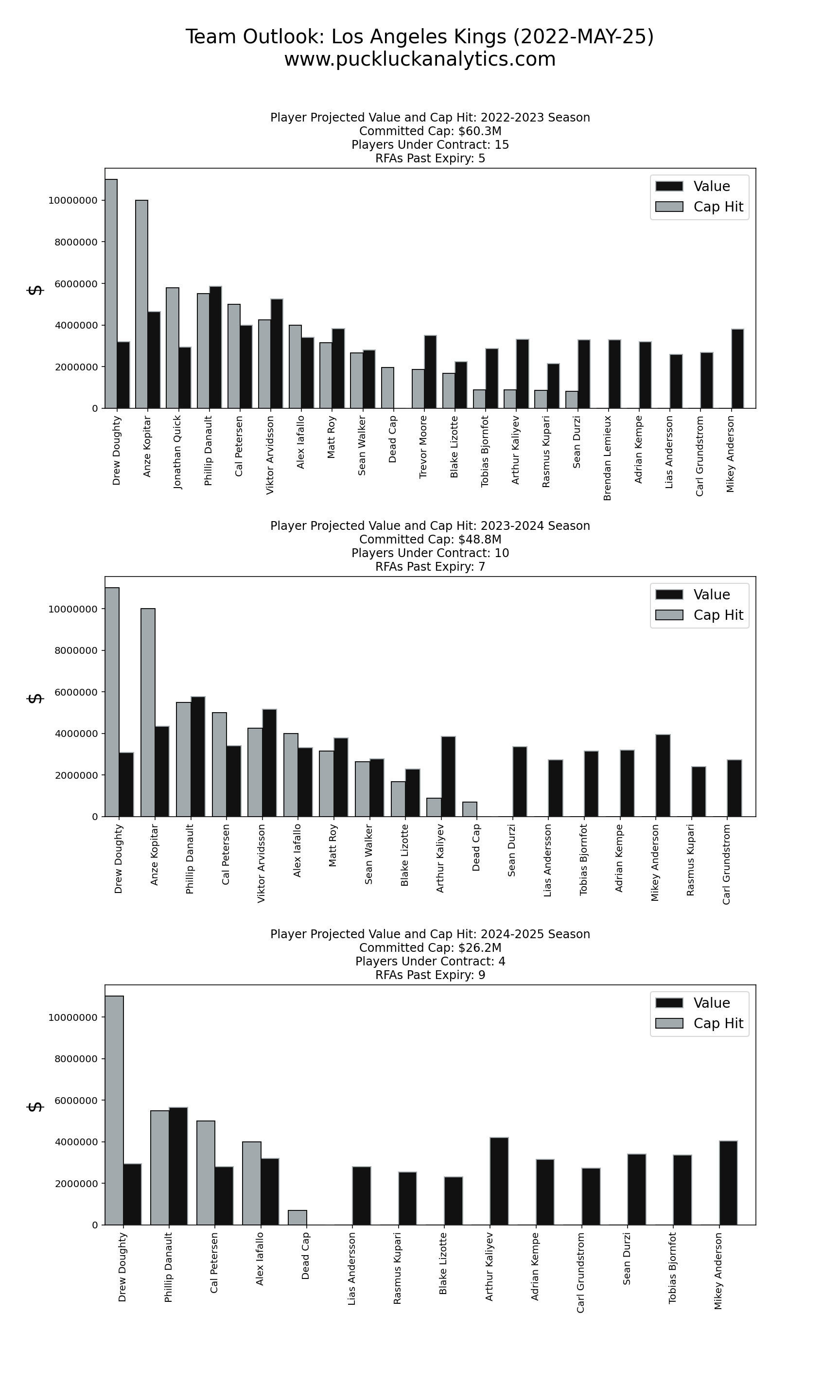

The Los Angeles Kings took the Pacific Division by storm in 21/22, with standout performances from some of their veterans and a healthy dose of youthful exuberance. It will be a difficult season to follow up and avoid taking a step back as the Kings try to pull out of their rebuild. Last summer’s acquisitions, Phillip Danault and Victor Arvidsson, look poised to take the reigns of a new emerging core.

Finishing was a big problem for the Kings in 21/22 and should be an area the Kings look to improve this summer. They had a number of young defensemen step up last season, but the blue line remains an area where they lack top end skaters.

The Kings have over $20M in cap space as they look ahead to the summer. They have an average of about $2.7M per player to fill out a 23 player roster, which gives them good flexibility as they look to add or extend 8 players. It should be enough to go after a big free agent or two that can fill one of the gaps we saw in their roster profile.

The Kings are at a crucial stage of their rebuild with a few of their key young players due for new deals. Adrian Kempe, who had a breakout season, and Mikey Anderson are both RFAs due for raises. With many more quality young players set to be in a similar position over the next few seasons, the Kings need to be careful not to overpay now. There’s plenty of cap space now, but it will quickly disappear as the Kings return to contention and more youngsters finish their ELCs. While it may be an uphill battle to repeat their 21/22 season performance, they have enough cap and roster flexibility that it’s possible. Similar to Seattle, the Kings could push toward playoff contender by October with a good offseason.

San Jose Sharks

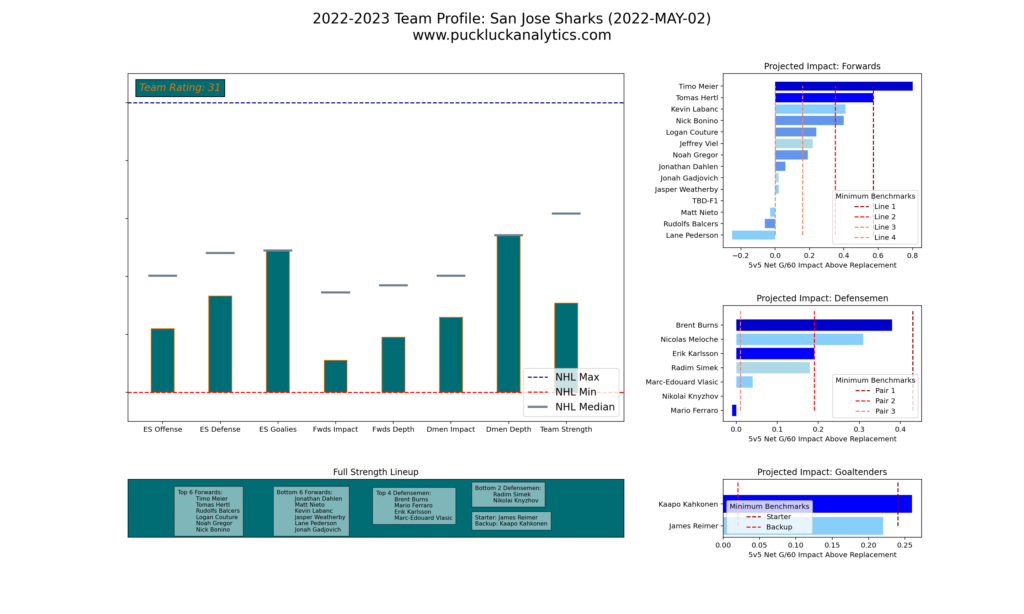

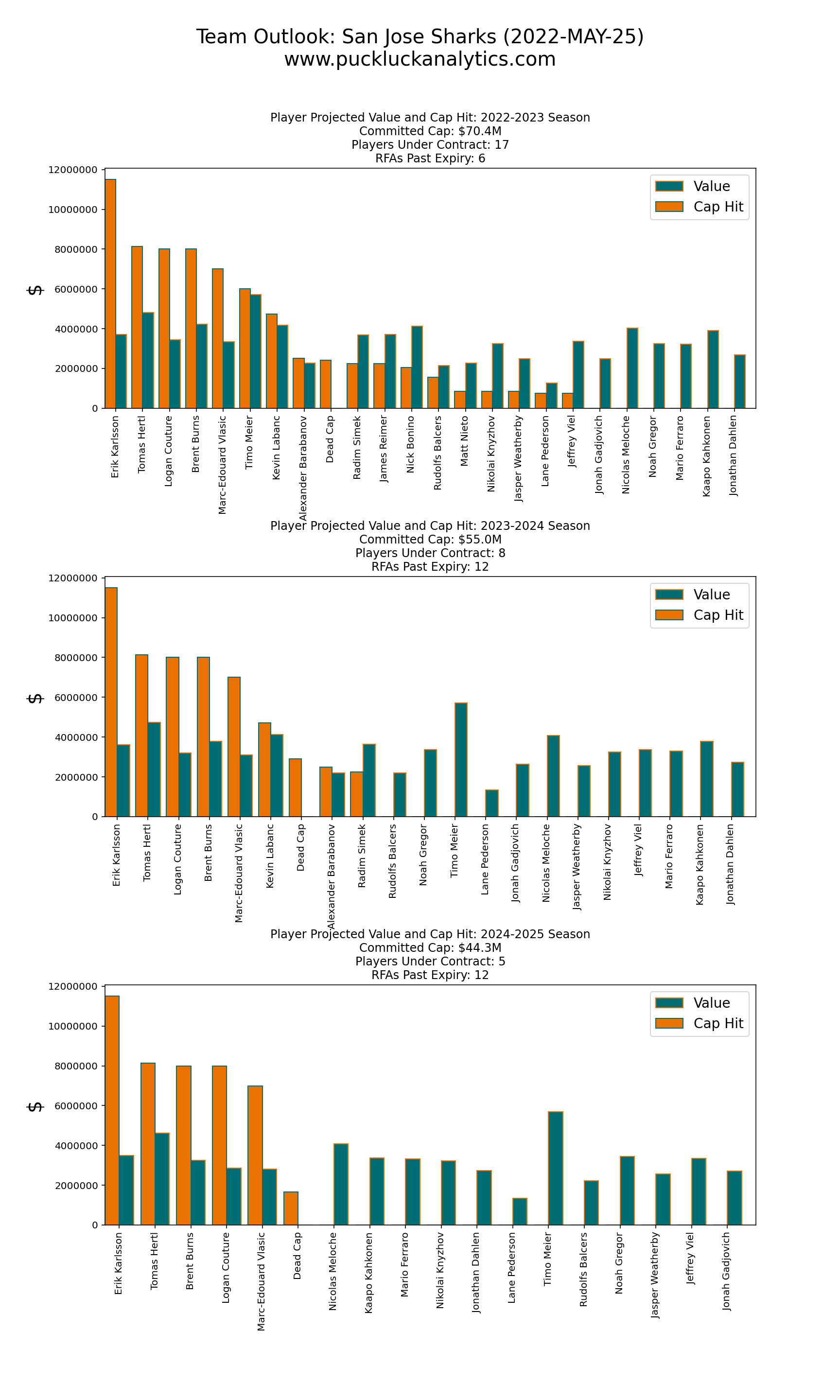

The San Jose Sharks are the first team we’ve looked at in the Pacific that doesn’t have a single category above average on their roster profile. They need all-around improvement if they hope to be a factor in the division next season.

The picture doesn’t get better when we consider the Sharks’ cap situation either. The core is getting older and the five highest cap hits are all projected to provide a fraction of their cap hit in value. The inefficient spending leaves them with about $12M in cap space for 6 players to complete their roster. It’s hard to see the Sharks improving significantly this offseason unless they can offload at least one of their big contracts.

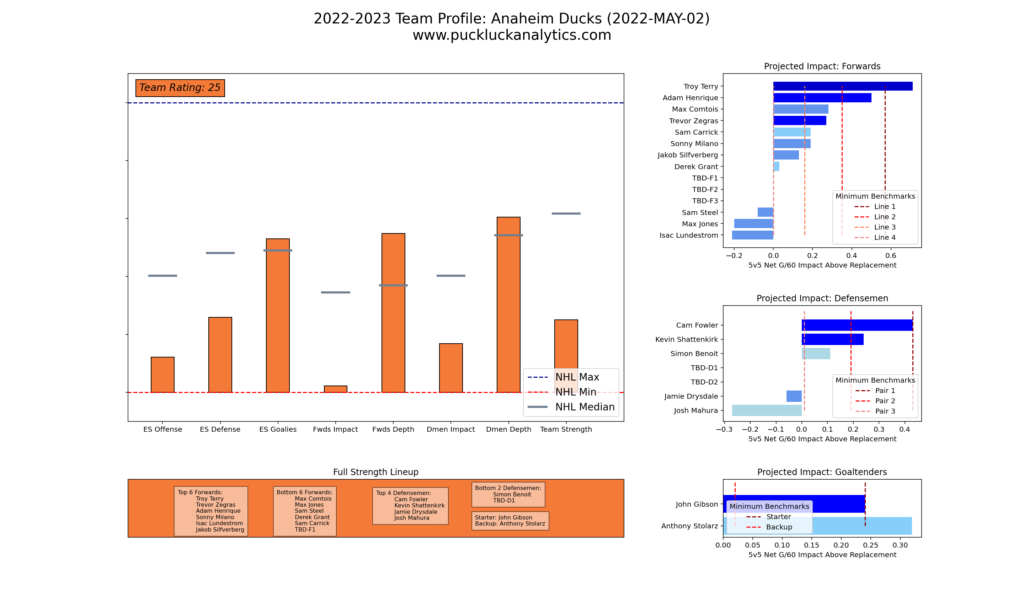

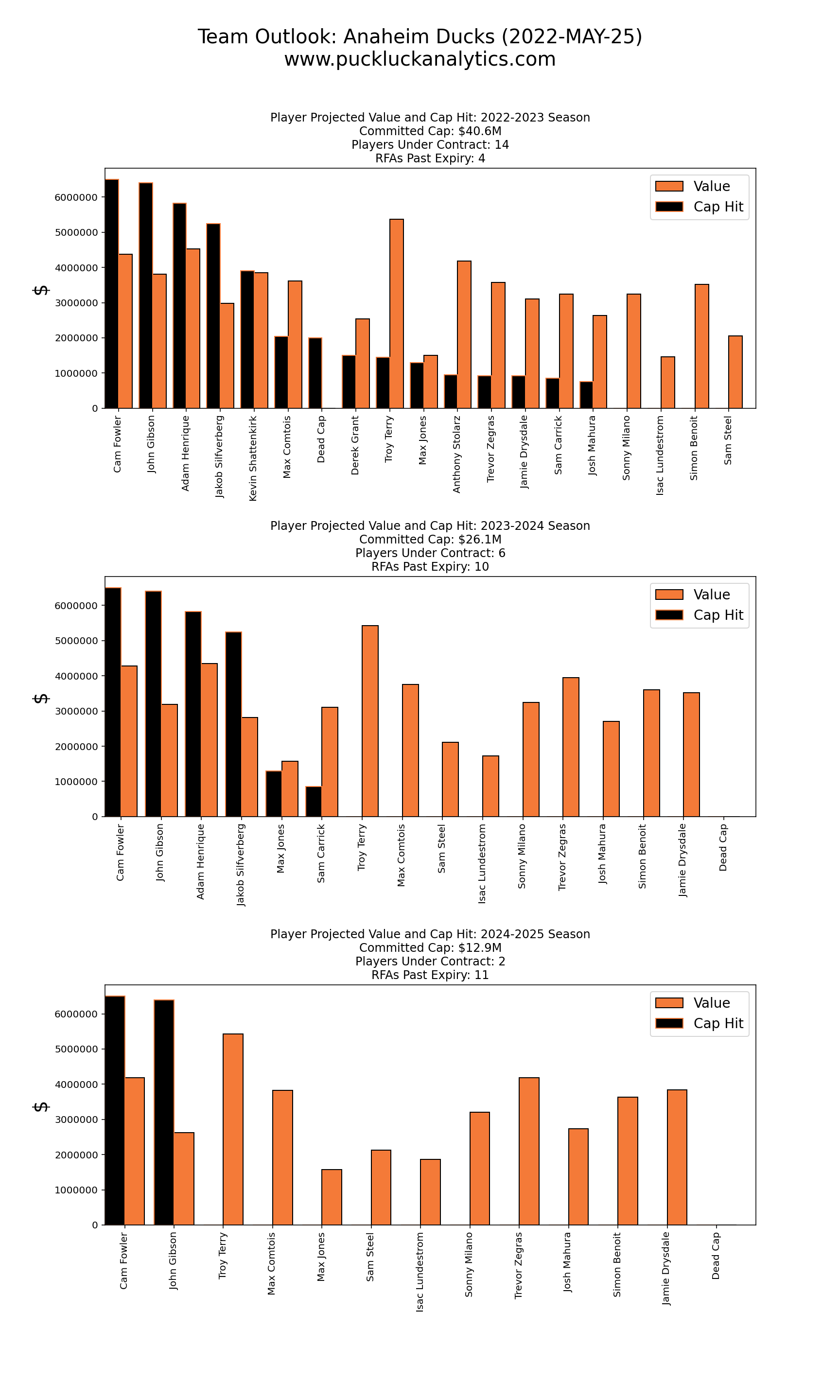

Anaheim Ducks

The Anaheim Ducks got off to a hot start in 21/22 but faded as the season went on. The Ducks have plenty of young prospects to be excited about, but it’s clear from their roster profile that their rebuild isn’t ready to turn the corner yet. They are short on high end players and overall depth.

The good news in Anaheim is that the Ducks have an eye-popping $40M in cap space this offseason. With 14 players under contract, they have by far the most flexibility in the division to improve over the summer. Landing too many high priced UFAs probably wouldn’t fit well with their rebuild, though, and it’s more likely they take a somewhat measured approach.

The Kings 2021 offseason blueprint may be a good starting point. They added a few veterans via trade and free agency to fill key roles, while they allowed their young players opportunities to see NHL action. It got the Kings into the playoffs last season, could the 22/23 Ducks do the same in 22/23?

Want to peruse the player projections behind the team profiles or browse UFA player cards for the addition your favorite team needs? Sign up for an annual membership to get access to all 22/23 team and player projection cards. Plots will be updated through the offseason as the 22/23 rosters take shape and updated to track progress through the season so you can follow along with the changing landscape.

Input data for models from Natural Stat Trick. Contract data from CapFriendly.