The Vancouver Canucks signed Andrei Kuzmenko to a 2 year extension yesterday. The deal comes with a cap hit of $5.5M as well as a modified no-trade clause (12 team no trade list). Let’s dig into the deal to see how it fits with Kuzmenko’s projected performance as well as the Canucks overall roster situation.

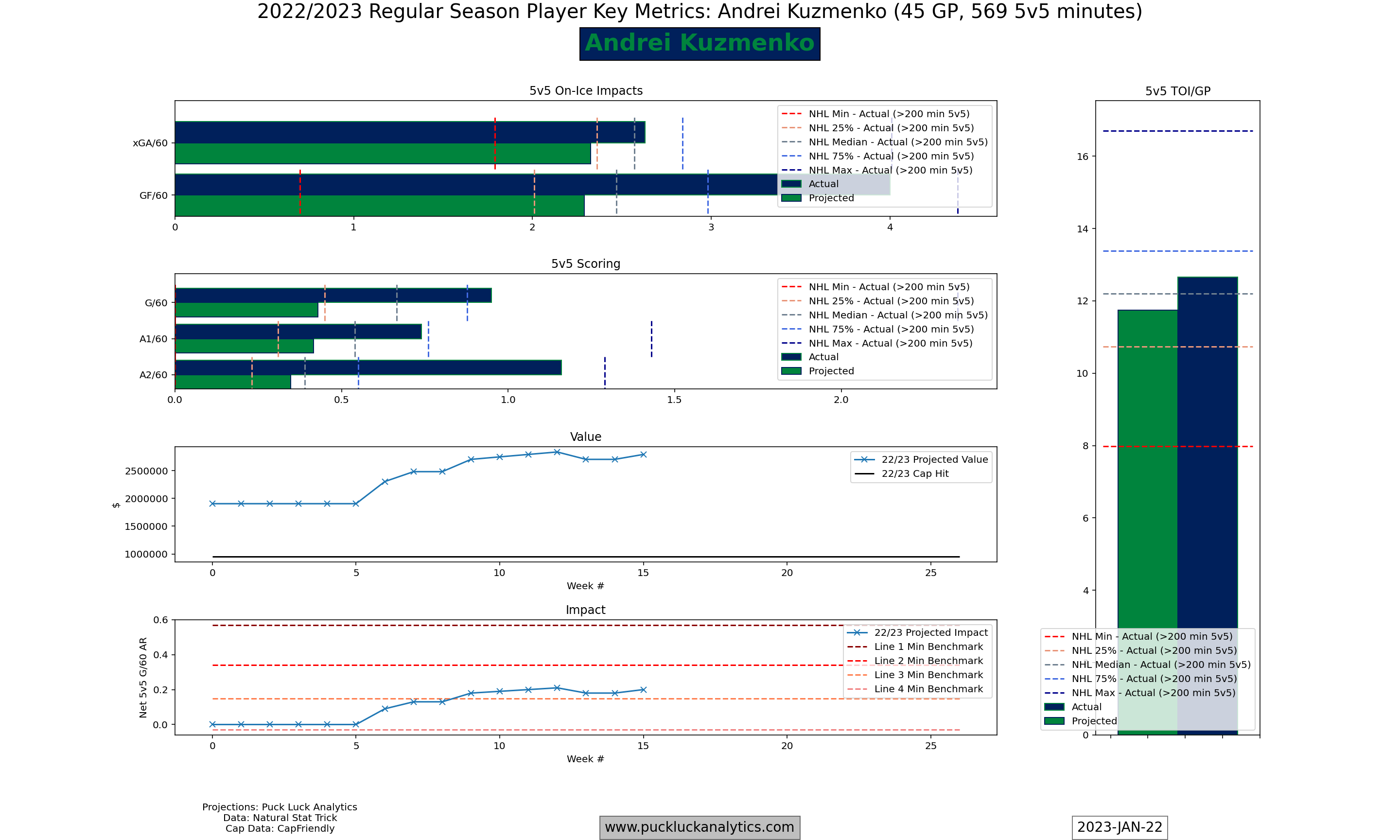

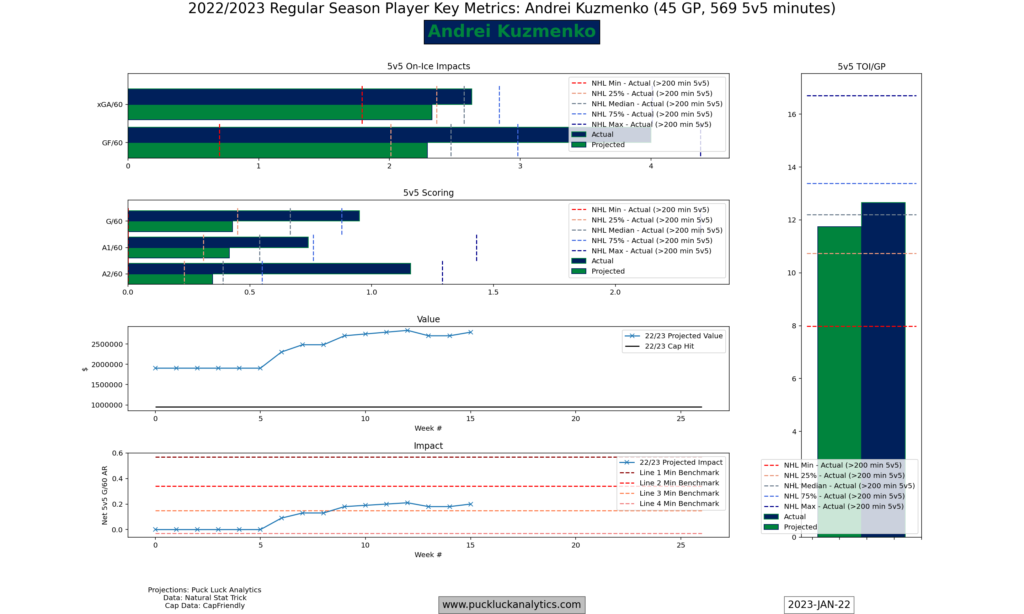

Current Season Performance

Kuzmenko has been a bright spot in an difficult season for the Canucks. He’s put up some excellent numbers riding shotgun with Elias Pettersson.

There are some signs that his current production is not sustainable. He’s shooting 19.3% at 5v5 this season. His line mates have also been red hot and he has a 5v5 on-ice SH% of 13.35%. Both of those numbers are approaching extremes in the NHL and are not sustainable in the long term. The model projection for Kuzmenko’s predicted impact over the next 82 games has leveled out in third line territory.

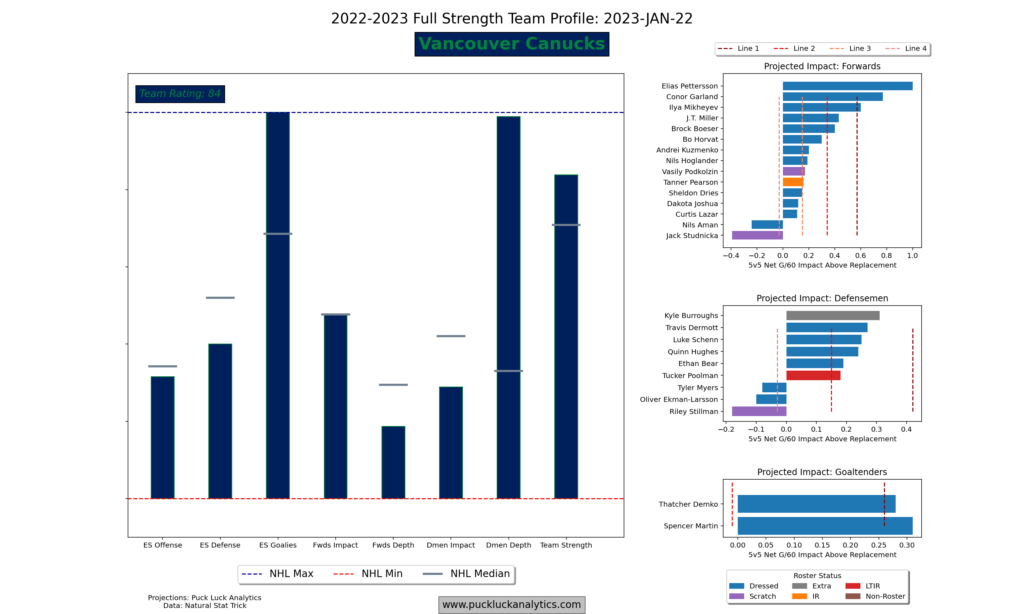

Canucks Roster Roadmap

The Canucks roster is in need of a major overhaul. The current roster profile is propped up by goaltending. The rest of the roster simply isn’t good enough to be considered a contender. The prospect pool is also in dire need of improvement, ranking 27th in the Hockey Prospecting model.

I recently put together a Roster Roadmap for the Canucks, laying out a strategy that would set them up to follow the Roster Regeneration teambuilding framework. Within the roadmap, the main priority was building up the future core with players and prospects in the 19-22 age range. Outside of players and prospects included in that future core and Elias Pettersson, all assets were expendable.

The Verdict

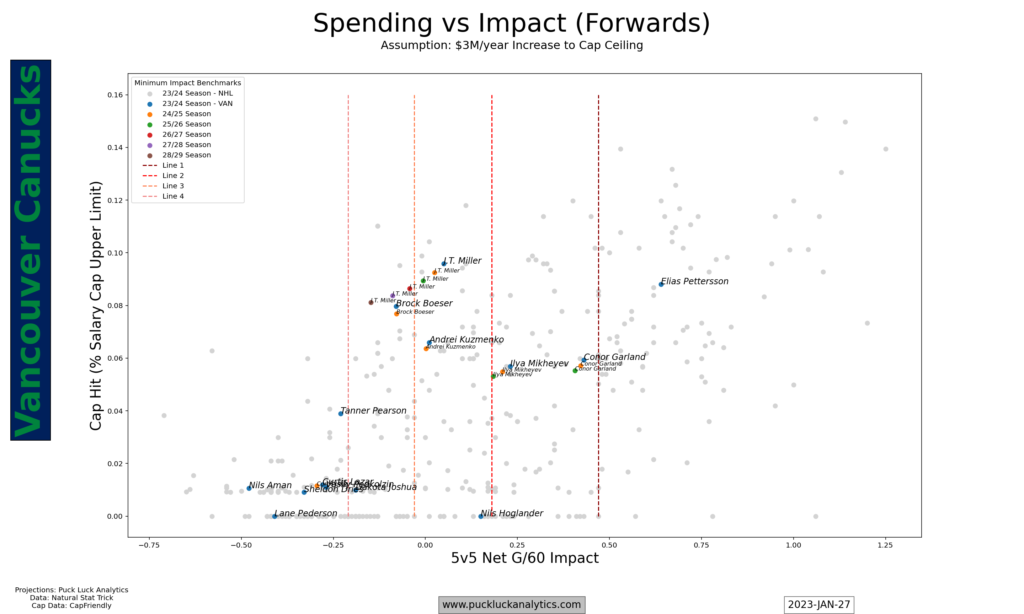

It feels like the Canucks missed a massive opportunity to sell high on a player in the midst of a strong season that’s been buoyed by some excellent shooting luck. Moving Kuzmenko as a rental to a contending team could likely have netted the Canucks a sizable return. Getting a good prospect for their future core certainly seems like it could have been part of a trade package.

Instead, the Canucks chose a short term extension for Kuzmenko. When his individual and on-ice shooting percentages inevitably regress, the $5.5M cap hit doesn’t look like it will be a steal. Using the preliminary model projections for next season, the Canucks have made a sizeable commitment for a 3rd line forward.

It’s hard to see a path for the Canucks to become contenders before the Kuzmenko extension expires. The Canucks have $74.5M committed to the 23/24 cap for just 15 contracts. With Kuzmenko now on the books, they most certainly don’t have enough cap space left to re-sign Bo Horvat. They will have to fill in the roster with near league minimum deals unless they can free up some cap space. The current trajectory seems to be to run it back, minus Horvat, and hope for a better result.

Historical player data from Natural Stat Trick. Contract data from CapFriendly.